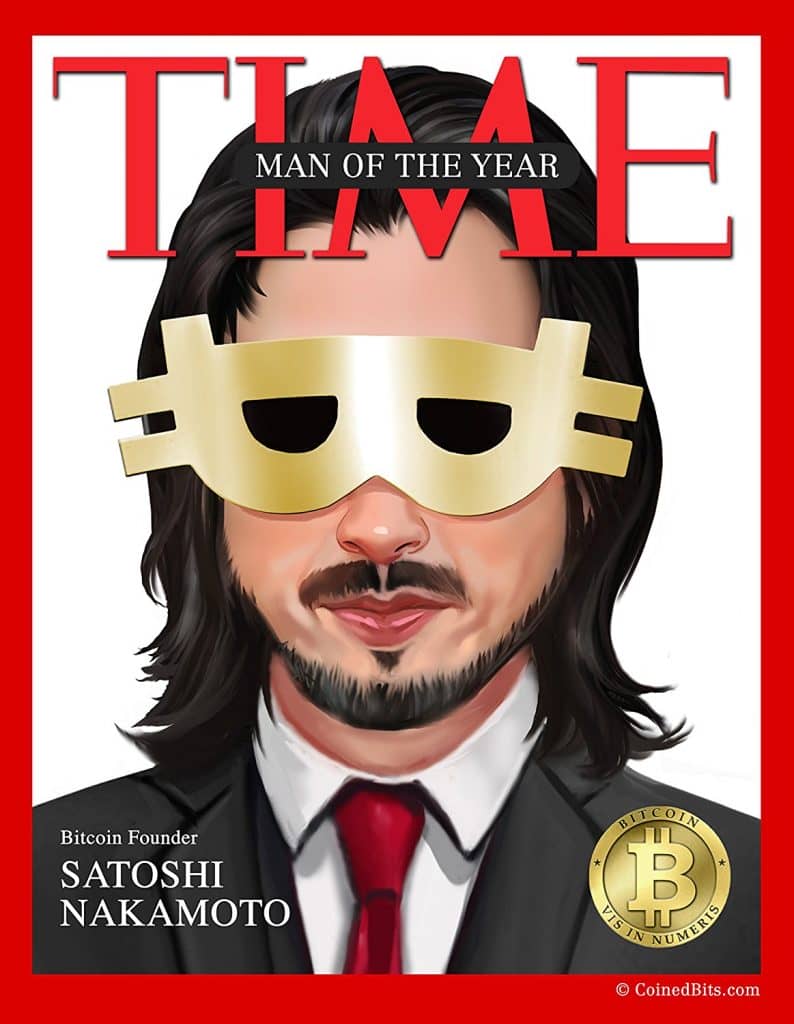

Could the world have ever imagined a decentralized digital currency back in 2008? Satoshi Nakamoto's revolutionary concept of Bitcoin changed the financial landscape forever, introducing a system where trust is not placed in institutions but in cryptographic proof. This peer-to-peer electronic cash system was not just an idea; it was a paradigm shift that promised transparency and security through blockchain technology. As we delve into the intricacies of this groundbreaking invention, one cannot help but marvel at its profound implications on global finance.

On October 31, 2008, an enigmatic figure under the pseudonym Satoshi Nakamoto published a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System. This document outlined a method for sending money electronically without relying on third-party intermediaries such as banks or payment processors. The core innovation behind Bitcoin lies in its use of blockchain—a distributed ledger technology that records transactions across numerous computers, ensuring they cannot be altered retroactively. By mining forum posts and emails between Nakamoto and members of the Bitcoin community from 2008, we gain insight into the foundational principles of this cryptocurrency.

| Name | Satoshi Nakamoto |

|---|---|

| Pseudonym | Presumed identity of the creator(s) of Bitcoin |

| Date of Publication | October 31, 2008 |

| White Paper Title | Bitcoin: A Peer-to-Peer Electronic Cash System |

| Key Contributions | Invented Bitcoin and introduced blockchain technology |

| Professional Background | Unknown; presumed expertise in cryptography and computer science |

| Notable Achievements | Established the first decentralized digital currency |

The abstract submitted by Satoshi Nakamoto in the white paper emphasized the need for a system where double-spending—the risk of spending the same digital token twice—is eliminated without central authority intervention. To achieve this, Nakamoto proposed a network where participants validate transactions using computational power, earning newly minted bitcoins as rewards. This process, known as mining, ensures the integrity of the blockchain while incentivizing participation. Over time, Bitcoin has evolved beyond its initial purpose, becoming both a store of value and a medium of exchange.

Andrew O’Hagan delves deeper into the mystery surrounding Satoshi Nakamoto in his article The Satoshi Affair. He explores the duality of fame and anonymity associated with the elusive creator of Bitcoin. Despite claims made by individuals like Craig Wright, who asserted to be the real Satoshi Nakamoto, the true identity remains undisclosed. What is certain, however, is the lasting impact of Nakamoto's work on modern economics and technology. The original definition of Bitcoin, published in 2008, laid the groundwork for countless other cryptocurrencies and applications built upon blockchain technology.

As Bitcoin gained traction, it faced skepticism from traditional financial institutions wary of its disruptive potential. Critics questioned its volatility, scalability, and environmental footprint due to energy-intensive mining operations. Yet proponents argued that these challenges were outweighed by the benefits of decentralization, privacy, and financial inclusion. For instance, Bitcoin wallets provide users with complete control over their funds, eliminating reliance on custodial services. Furthermore, the limited supply of 21 million bitcoins ensures scarcity, making it akin to digital gold.

From a technical standpoint, the Bitcoin protocol employs advanced cryptographic techniques to secure transactions. Each block in the chain contains a hash linking it to the previous block, along with transaction data and a timestamp. Miners compete to solve complex mathematical puzzles, adding new blocks to the chain and receiving bitcoin rewards. This consensus mechanism, called Proof of Work (PoW), guarantees network security even when some participants act maliciously. Although alternative consensus algorithms have emerged, PoW remains integral to Bitcoin's operation.

Despite its early adoption by tech enthusiasts and libertarians, Bitcoin gradually attracted mainstream attention. Major companies began accepting it as payment, and institutional investors entered the market through derivatives and exchange-traded funds (ETFs). Governments worldwide responded with varying degrees of regulation, ranging from outright bans to supportive frameworks aimed at fostering innovation. Meanwhile, developers continued improving the protocol, implementing upgrades like Segregated Witness (SegWit) and Lightning Network to enhance efficiency and reduce fees.

Looking ahead, Bitcoin's role in shaping the future of money remains uncertain yet promising. Its success depends on addressing existing limitations while preserving its defining characteristics. Innovations in layer-two solutions, cross-chain interoperability, and sustainable mining practices could propel Bitcoin further into the global economy. Moreover, ongoing research into quantum-resistant cryptography may fortify its long-term viability against emerging threats.

Regardless of its ultimate trajectory, Bitcoin's legacy as a pioneering experiment in decentralized finance endures. It challenged conventional wisdom about money, inspiring a generation of entrepreneurs and technologists to reimagine how value can be exchanged in the digital age. From humble beginnings as a nine-page white paper authored by an unknown entity named Satoshi Nakamoto, Bitcoin grew into a multibillion-dollar industry influencing countless lives around the globe.

The publication of the Bitcoin white paper marked a turning point in history, offering a glimpse into what financial systems might look like in a post-institutional world. While debates persist regarding its merits and drawbacks, there is no denying the transformative power of Nakamoto's vision. As the story unfolds, one thing becomes clear: Bitcoin is more than just a currency—it represents freedom, resilience, and human ingenuity at its finest.